The IRS recently issued its 2023 cost-of-living adjustments for more than 60 tax provisions. With inflation up significantly this year, many amounts increased considerably over 2022 amounts. As you implement 2022 year-end tax planning strategies, be sure to take these 2023 adjustments into account.

Also, keep in mind that, under the Tax Cuts and Jobs Act (TCJA), annual inflation adjustments are calculated using the chained consumer price index (also known as C-CPI-U). This increases tax-bracket thresholds, the standard deduction, certain exemptions and other figures at a slower rate than was the case with the consumer price index previously used, potentially pushing taxpayers into higher tax brackets and making various breaks worth less over time. The TCJA adopts the C-CPI-U on a permanent basis.

Individual income taxes

Tax-bracket thresholds increase for each filing status but, because they are based on percentages, they increase more significantly for the higher brackets. For example, the top of the 10% bracket increases by $725, to $1,450, depending on filing status, but the top of the 35% bracket increases by $22,950 to $45,900, again depending on filing status.

The TCJA suspended personal exemptions through 2025. However, it nearly doubled the standard deduction, indexed annually for inflation through 2025. For 2023, the standard deduction will be $27,700 (married couples filing jointly), $20,800 (heads of households), and $13,850 (singles and married couples filing separately). After 2025, standard deduction amounts are scheduled to drop back to the amounts under pre-TCJA law unless Congress extends the current rules or revises them.

Changes to the standard deduction could help some taxpayers make up for the loss of personal exemptions. But it might not help taxpayers who typically used to itemize deductions.

AMT

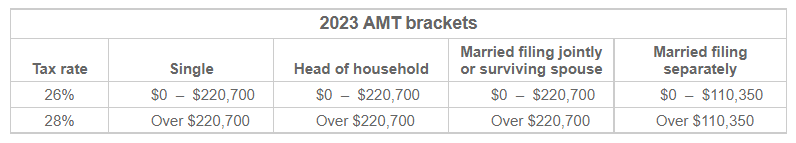

The alternative minimum tax (AMT) is a separate tax system that limits some deductions, does not permit others and treats certain income items differently. If your AMT liability is greater than your regular tax liability, you must pay the AMT.

Like the regular tax brackets, the AMT brackets are annually indexed for inflation. For 2023, the threshold for the 28% bracket will increase by $14,600 for all filing statuses except married filing separately, which increased by half that amount.

The AMT exemptions and exemption phaseouts are also indexed. The exemption amounts for 2023 will be $81,300 for singles and $126,500 for joint filers, increasing by $5,400 and $8,400, respectively, over 2022 amounts. The inflation-adjusted phaseout ranges for 2023 will be $578,150 – $903,350 (singles) and $1,156,300 – $1,662,300 (joint filers). Amounts for married couples filing separately are half of those for joint filers.

Education and child-related breaks

The maximum benefits of certain education and child-related breaks generally remain the same for 2023. But most of these breaks are limited based on a taxpayer’s modified adjusted gross income (MAGI). Taxpayers whose MAGIs are within an applicable phaseout range are eligible for a partial break and breaks are eliminated for those whose MAGIs exceed the top of the range.

The MAGI phaseout ranges will generally remain the same or increase modestly for 2023, depending on the break. For example:

- The American Opportunity credit – For tax years beginning after December 31, 2020, the MAGI amount used by joint filers to determine the reduction in the American Opportunity credit is not adjusted for inflation. The credit is phased out for taxpayers with MAGI in excess of $80,000 ($160,000 for joint returns). The maximum credit per eligible student is $2,500.

- The Lifetime Learning credit – For tax years beginning after December 31, 2020, the MAGI amount used by joint filers to determine the reduction in the Lifetime Learning credit is not adjusted for inflation. The credit is phased out for taxpayers with MAGI in excess of $80,000 ($160,000 for joint returns). The maximum credit is $2,000 per tax return.

- The adoption credit – The phaseout ranges for eligible taxpayers adopting a child will also increase for 2023 — by $15,820, to $239,230 – $279,230 for joint, head-of-household and single filers. The maximum credit will increase by $1,060, to $15,950 for 2023. Note: Married couples filing separately generally are not eligible for these credits.

These are only some of the education and child-related breaks that may benefit you. Keep in mind that, if your MAGI is too high for you to qualify for a break for your child’s education, your child might be eligible to claim one on his or her tax return.

Gift and estate taxes

The unified gift and estate tax exemption and the generation-skipping transfer (GST) tax exemption are both adjusted annually for inflation. For 2023, the amounts will be $12.92 million (up from $12.06 million for 2022).

The annual gift tax exclusion will increase by $1,000 to $17,000 for 2023.

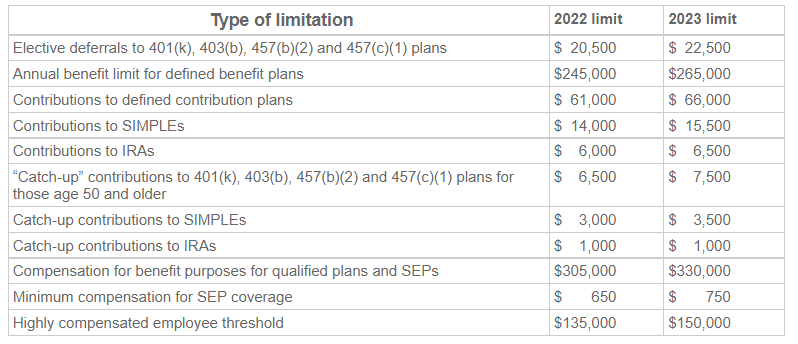

Retirement plans

Nearly all retirement-plan-related limits will increase for 2023. Thus, depending on the type of plan you have, you may have limited opportunities to increase your retirement savings if you have already been contributing the maximum amount allowed.

Your MAGI may reduce or even eliminate your ability to take advantage of IRAs. Fortunately, IRA-related MAGI phaseout range limits all will increase for 2023:

Traditional IRAs

MAGI phaseout ranges apply to the deductibility of contributions if a taxpayer (or his or her spouse) participates in an employer-sponsored retirement plan:

For married taxpayers filing jointly, the phaseout range is specific to each spouse based on whether he or she is a participant in an employer-sponsored plan:

- For a spouse who participates, the 2023 phaseout range limits will increase by $7,000, to $116,000 – $136,000.

- For a spouse who does not participate, the 2023 phaseout range limits will increase by $14,000, to $218,000 – $228,000.

For single and head-of-household taxpayers participating in an employer-sponsored plan, the 2023 phaseout range limits will increase by $5,000, to $73,000 – $83,000.

Taxpayers with MAGIs in the applicable range can deduct a partial contribution; those with MAGIs exceeding the applicable range cannot deduct any IRA contribution.

But a taxpayer whose deduction is reduced or eliminated can make nondeductible traditional IRA contributions. The $6,500 contribution limit for 2023 (plus $1,000 catch-up, if applicable, and reduced by any Roth IRA contributions) still applies. Nondeductible traditional IRA contributions may be beneficial if your MAGI is also too high for you to contribute (or fully contribute) to a Roth IRA.

Roth IRAs

Whether you participate in an employer-sponsored plan doesn’t affect your ability to contribute to a Roth IRA, but MAGI limits may reduce or eliminate your ability to contribute:

For married taxpayers filing jointly, the 2023 phaseout range limits will increase by $14,000, to $218,000 – $228,000.

For single and head-of-household taxpayers, the 2023 phaseout range limits will increase by $9,000, to $138,000 – $153,000.

You can make a partial contribution if your MAGI falls within the applicable range, but no contribution if it exceeds the top of the range.

Note: Married taxpayers filing separately are subject to much lower phaseout ranges for both traditional and Roth IRAs.

Crunching the numbers

With the 2023 cost-of-living adjustment amounts soaring higher than 2022 amounts, it’s important to understand how they might affect your tax and financial situation. We are happy to help crunch the numbers and explain the best tax-saving strategies to implement based on the 2023 numbers.