Click here to view PDF.

“It is perfectly reasonable to assume a long-run correlation between the stock market and the performance of the economy. In practice, there is a loose relationship with occasional large deviations.”

Martin Barnes, Bank Credit Analyst

“As it is, low rates beget lower rates (or no rates). Radical policy begets more radical policy; public debt, more public debt; …” James Grant, Grant’s Interest Rate Observer

Another quarter has passed in what can only be described as the most extraordinary year in my now thirty-year investment career. While I will leave the ultimate narrative with historians far more qualified than me, it is difficult to write an interpretation of the current market environment without acknowledging the building level of angst present in our society. While this is easily the most challenging commentary that I have written, it seems disingenuous to gloss over the challenges we face and simply report on the markets. In fact, I find our challenges to be materially relevant to any outlook with respect to the economy and ultimately financial markets. So here goes – “unprecedented”, “uncertain” – pick your descriptor for the crisis environment in which we live. As investors, we are charged with taking a dispassionate view to assess markets assuming a normal environment or to anticipate a relatively quick return to normal. The facts, however, seemingly couldn’t be further from “normal” today. To list a few:

- A virus, for which the timing and efficacy of a vaccine remain unknown, hangs over the globe.

- The coming presidential election, arguably the most consequential of our lifetimes, faces a contentious resolution in a dangerously heightened environment of partisanship.

- Decades of building wealth inequality are now being compounded by a “k” shaped economy disproportionately favoring top quartile earners while bottom quartile incomes are down ~20%.

- Issues around race and equality should, and will, remain a focus at all levels of society.

- The Federal Reserve continues to buy securities at a monthly rate 50% above the pace during post-2008 Quantitative Easing.

- Republicans and Democrats are debating an additional stimulus package the low end of which would have made both sides blush a mere twelve months ago.

We face these extreme challenges both economically and societally while our trust in individuals and institutions alike has seemingly reached a nadir. These challenges will affect society, the economy and markets in ways that cannot be known. While I am ultimately an optimist when it comes to the future of our country, I fear the current transitory period will result in volatility and uncertainty creating a potentially more challenging set up for the economy and financial markets.

Turning to the Markets

And yet, the stock market continues to move inexorably higher…

There is an adage that the stock market climbs a “wall of worry”, possibly an explanation for the initial rebound from the March pandemic lows. However, I would posit the climb back to and beyond all time highs feels more like the market riding a wave of liquidity (thank you Chairman Powell) periodically interrupted by presidential tweets. The risk to a liquidity driven rally, to paraphrase Jim Grant, is that to sustain momentum, the extraordinary policies of yesterday must be even more extraordinary tomorrow. Markets seem increasingly convicted in this scenario of ramping policy support with speculative activity naturally following. How else to explain current dynamics in the market: more stocks have risen at least 400% this year for the first time since 2000, Special Purpose Acquisition Companies (SPACs or “blank check companies”) have raised $43B, Tesla’s market cap is four times larger than the big three automakers combined, Apple’s market cap is three times larger than the entire energy sector, options trading exceeding the volume of individual stock trading. The list goes on…

Yet, there remains a clear disconnect between the economy and asset prices (visions of Wile E. Coyote suspended in mid-air come to mind). Markets are hitting all-time highs, home ownership rates are approaching pre-2008 highs while unemployment remains elevated and real-time economic data appears to have stalled. While many analysts will submit that the market is not the economy, this seems quite shortsighted. I will submit to Martin Barnes view that while the market may diverge at points in time over the course of a cycle, ultimately markets must return to underlying fundamentals.

Challenges for Long Term Investors

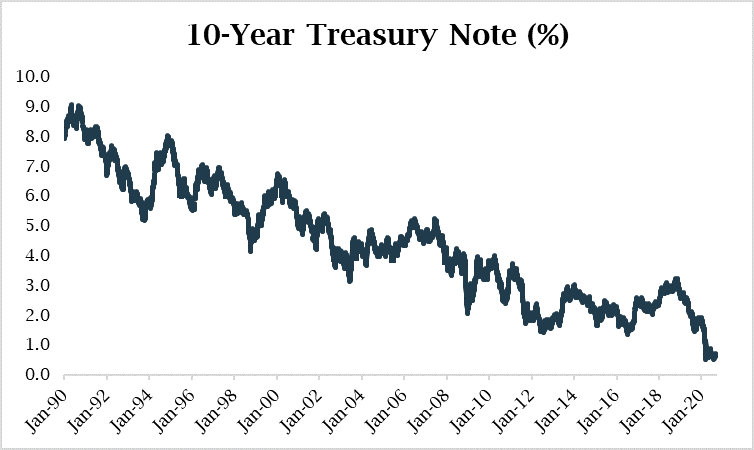

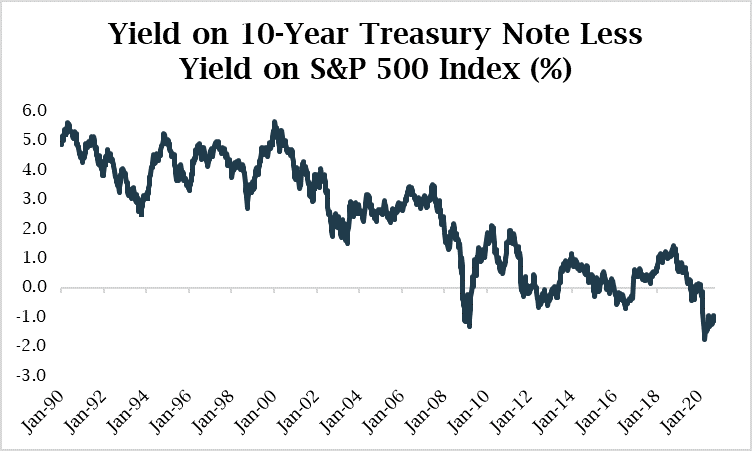

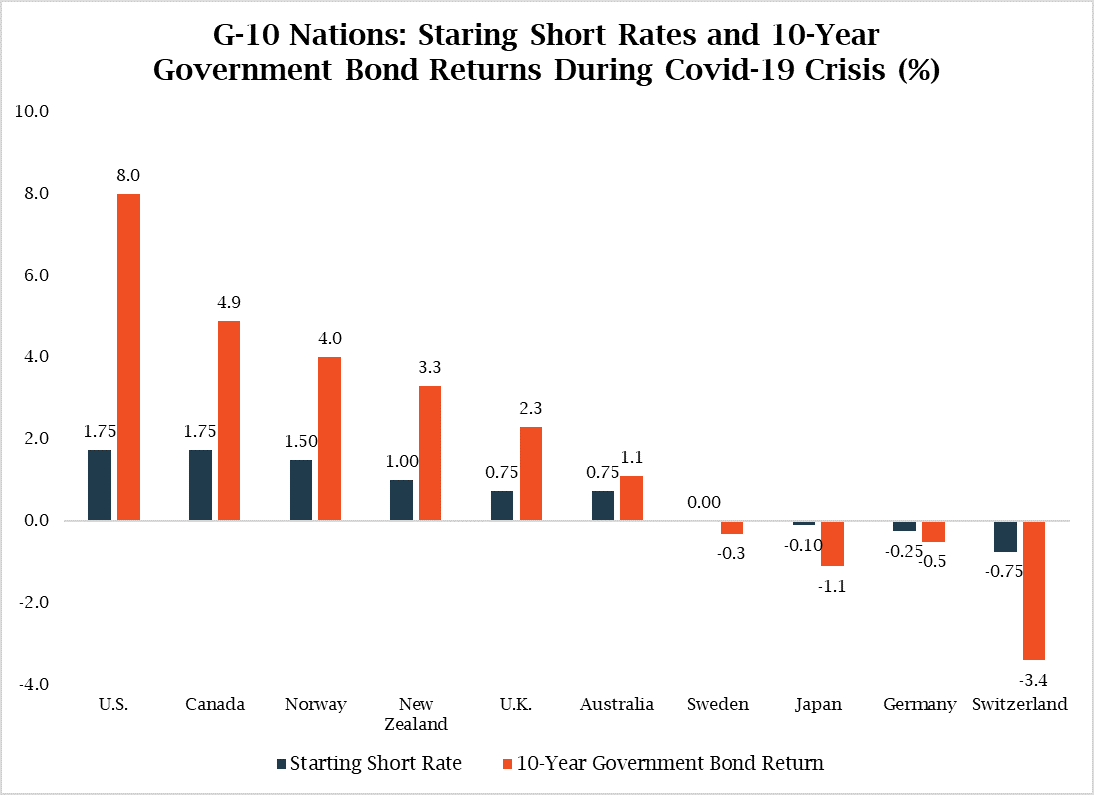

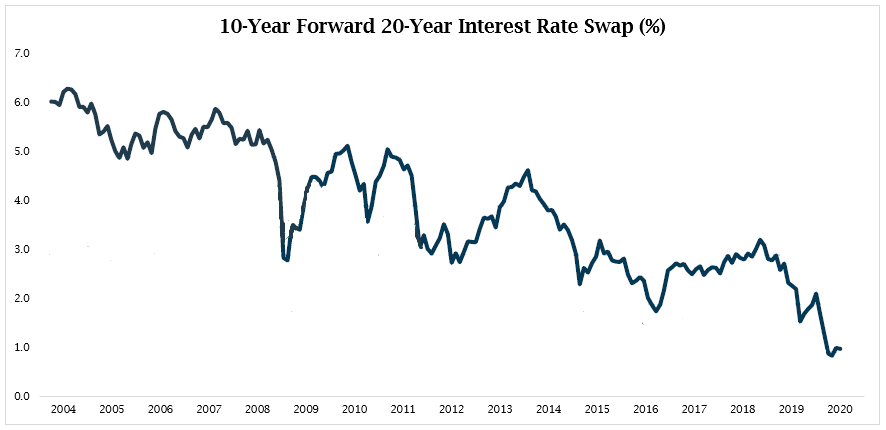

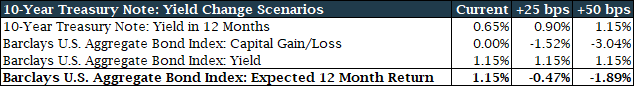

Long term investors now face an environment where equities approach all-time highs and valuations are stretched on any metric not related to interest rates, which have been driven to all-time lows by Federal Reserve policy. As aptly described in an attached note from my colleague, Cary Baronian, the role of fixed income in balanced accounts is increasingly challenged as the primary attributes of fixed income (income and diversification) are diminished at the current level of rates. As such, the traditional balanced approach to portfolio management should be rethought in the context of each investors long term goals, liquidity needs and ability to accept volatility. Solutions to counteract the lack of income available through traditional fixed income must be assessed with a continued emphasis on risk management – simply attempting to maximize income has its own set of challenges. Over the course of the last quarter, we have taken multiple steps to enhance portfolio positioning to reflect this challenge including:

- A shift out of investment grade corporate bonds into comparably rated municipal bonds where rates are modestly higher on even a pretax basis.

- Reduced portfolio weights in areas of the market (including megacap tech stocks) where expectations appear high while adding positions in the bank and energy sectors where valuations provide a margin of safety, balance sheets are solid and dividend yields are compelling.

- Initiated a position in a gold miner, Newmont, to reflect a longer-term thesis of higher real asset prices as an outcome of current monetary policy.

In closing, to quote Martin Barnes one more time, “It currently is very difficult for institutional investors to favor fixed-income instruments over a higher-yielding equity market. However, there is no free lunch here. We cannot ignore the argument that low interest rates reflect a very bleak long-run outlook for economic growth and thus for earnings and stock prices.” We began this note speaking to the deep-seated challenges and near-term risks facing the country and the economy. The combination of this environment and heightened asset prices argues strongly for a continued emphasis on risk management in client portfolios. Attempting to maximize returns in this environment seems misguided when looking at prospective returns versus underlying risk. We remain committed to emphasizing quality businesses through diligent research and are positioned to take advantage of long-term opportunities that patience will reward. We look forward to continuing to work with each of you to ensure the appropriate balance for your portfolio.

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis Source: Morningstar

Source: Morningstar

Source: GMO

Source: GMO Source: BlackRock

Source: BlackRock