“The price you pay determines your rate of return.” – Warren Buffett

Financial markets have delivered a bit of something for everyone, bulls and bears alike, over the last few years. In the midst of the current momentum-oriented period for equity markets, a quick note regarding the Heritage approach to managing client portfolios: Our investment philosophy is based on taking long-term views with the intent to deliver superior risk-adjusted returns for our clients over a market cycle. History, and the math, are clear: Building portfolios designed to participate in rising markets while focusing on capital preservation during periods of elevated risks allows clients to achieve long-term goals while experiencing lower levels of volatility. The post-pandemic market has been a test of our process and philosophy, and we are proud of the results we have generated for clients.

At a glance, the second quarter appears to be more of the same … to borrow from last quarter’s note, falling inflation, stabilizing interest rates, solid earnings growth and more than a sprinkle of “AI” have combined to propel markets to successive new highs. Investor sentiment remains positive, if not increasingly speculative, boosted by the prevailing narrative of a soft economic landing, the potential for a more accommodative Federal Reserve and an extraordinary, if unquantifiable, capital spending cycle associated with artificial intelligence. Peeling back the onion, however, reveals a more challenging narrative reflecting building risks for both financial markets as well as the economy.

Last quarter, we described a set of possible economic scenarios (“Fire” and “Ice”), either of which would likely create challenges for financial markets. This quarter, we are going to build on the broader risks to markets borrowing from Marko Kolanovic, the former chief global markets strategist at JP Morgan. Below we summarize a couple of his views (in Italics) with our additional thoughts and color:

- Most of the returns are concentrated in a few megacap stocks

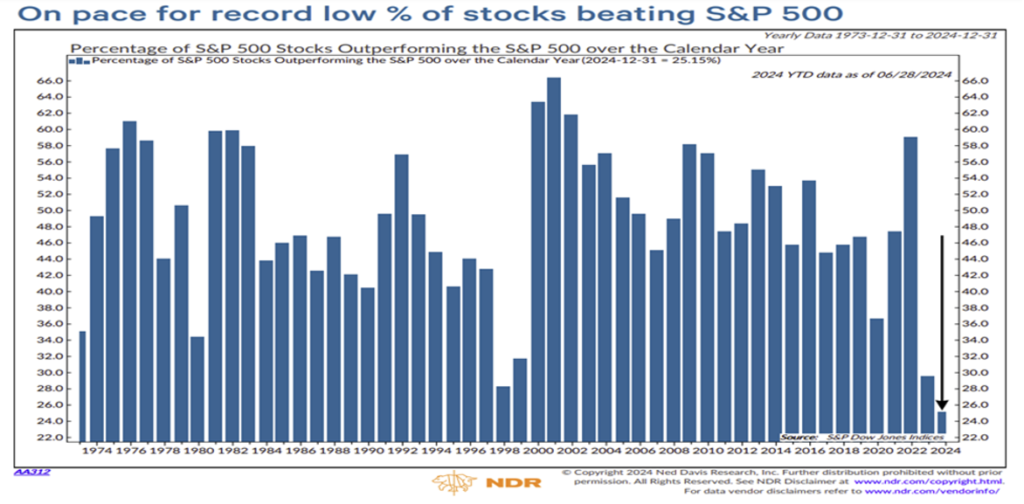

After a first quarter where equity markets showed increasing breadth across geographies, market capitalizations, and sectors, the second quarter has been dominated by a few megacap stocks exposed to the aforementioned capital spending cycle associated with AI. While Nvidia alone accounted for ~40% of the S&P 500 return in the second quarter, the average stock was down. As a result, we have only seen this level of concentration in index returns two other times in the last fifty years: the Nifty Fifty period in the early 1970s and the dot-com boom in the late 1990s (see chart below).

- To keep the momentum going, the mega-caps will have to keep beating consensus estimates.

As in prior periods where markets have narrowed, a limited number of stocks (the Fab 5 plus Nvidia) have been beneficiaries of material optimism with respect to a particular theme, in this case an extended capital spending cycle. - Those estimates encode expectations of double-digit growth for the foreseeable future.

The combination of aggressive earnings expectations (in the case of Nvidia, triple digit growth expectations) and inflated valuations leaves little room for error with respect to a continued economic and capital spending tailwind.

- The business cycle is moving sideways at best, with the low-end consumer under stress.

Our partners at BCA lay out a credible case for a weakening economy as we move into year end. Declining job openings, easing wage growth, depleted consumer excess savings and rising credit delinquencies all point to a slowdown in consumer spending. Leading indicators of business spending and construction spending provide little support as an offset. - Rapid rate cuts are unlikely, and even if they occur, the long end of the curve — which is the discount rate for risk assets — could stay high

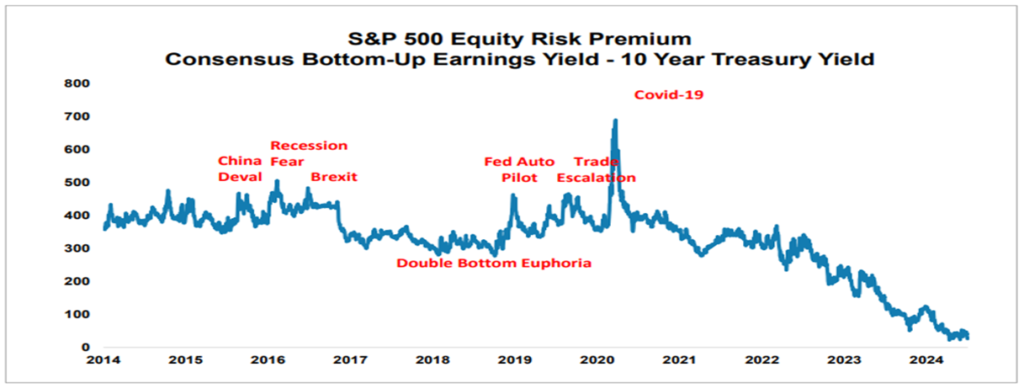

While signs of economic slowing will likely push the Federal Reserve to cut rates in the fall, the combination of continued fiscal deficits and inflation returning to the long-term trend line for the first time since the financial crisis may keep long rates higher for longer. - The equity risk premium is very low

While valuations say little about the short-term outlook for stocks, the combination of aggressive earnings expectations, high valuations and a “normalized” risk free rate suggest disappointing long-term returns.

Source: Morgan Stanley

Against this backdrop, we have taken additional steps to position client portfolios for what we believe may be a period of significant volatility in equity markets. Equity allocations remain below long-term targets with a continued emphasis on large cap US equities with more stable underlying revenue and earnings growth. We have taken steps to lower the economic sensitivity of our holdings, taking down our exposure to the banking sector while continuing to avoid small cap stocks and underweight international equities. We added a position in Duke Energy based on a compelling combination of accelerating earnings and attractive valuation. Geopolitical uncertainty, easing global central bank policies and the potential for heightened volatility in financial assets continues to argue for a core position gold. We view fixed income investments through the lens of capital preservation and current income. We continue to avoid lower credit quality issuers while taking advantage of the current income and optionality of shorter-term investment grade fixed income.

While markets swing between extremes of optimism and pessimism, Buffett is correct – the price that you pay for a good asset is the ultimate determiner of the long-term return. We will continue to manage portfolios to be reflective of our assessment of heightened risk in markets with meaningful liquidity to take advantage of potential volatility.

We appreciate the confidence that you have placed in our firm. We look forward to discussing your specific portfolio allocations and positioning.