We believe it is important to provide you with an update on our investment strategy during this highly volatile market. As you know, we have been positioning for a challenging environment which has helped preserve capital in client portfolios. With the broad U.S. equity market down -18% from its all-time high, several of you have asked: When will we begin buying? We believe that continuing to exercise patience is appropriate. Below is a summary of our thinking:

- We are monitoring the price level of the broad U.S. equity market and considering a range at which we would we begin adding to our equity allocations in client portfolios.

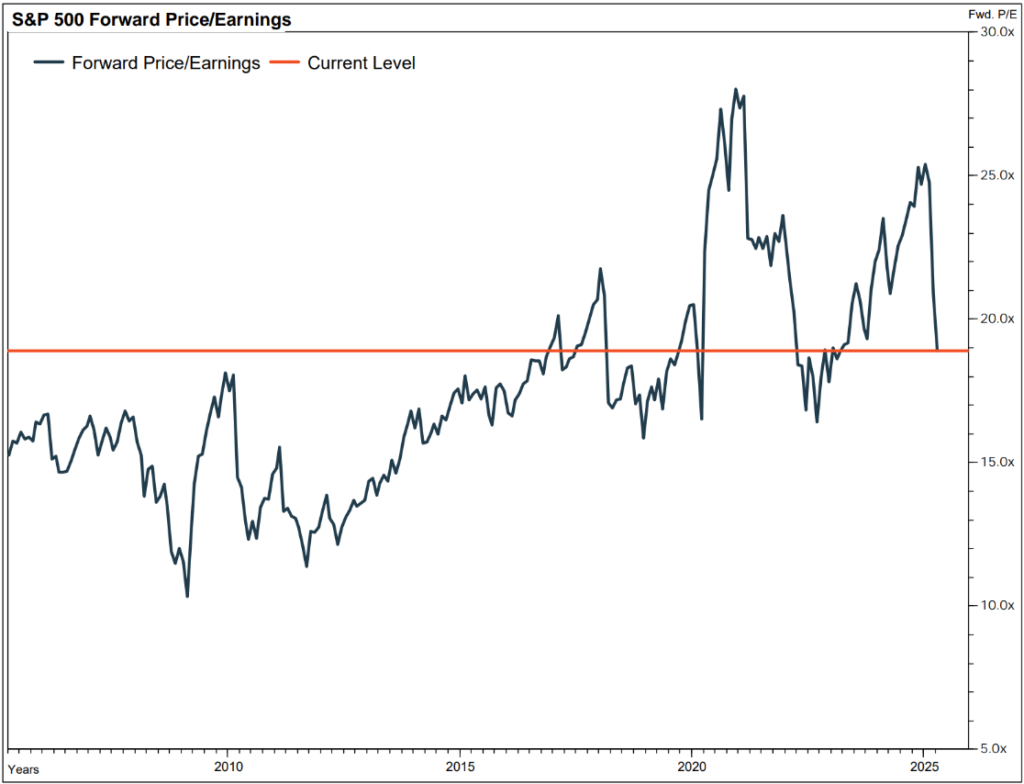

- A common measure of price is applying a multiple to earnings. As shown below, the S&P 500 is currently trading at 18x expected 2025 earnings.

Source: Factset

You can see the multiple has contracted to the pre-pandemic level but remains elevated compared to averages over the last 20 years. It is worth considering why multiples were elevated coming out of the pandemic. A common view is that fiscal stimulus pushed money into the market, causing multiples to expand. If the new Administration continues to shift towards fiscal restraint, then the current multiple doesn’t look compelling. In fact, it may imply below-average future returns.

- The other component of the calculation is earnings. Earnings expectations have come down by 7% since September but have been steady since Liberation Day, suggesting that the potential negative impacts of tariffs on earnings are not reflected in the earnings outlook and the current multiple is artificially low. Earnings are expected to grow by 12% this year. If the tariffs aren’t lifted or there isn’t meaningful progress in negotiations quickly, then earnings estimates may have room to decline.

- Take the example of applying an 18x multiple to flat earnings in 2025. The implied price level for the broad U.S. equity market under these assumptions is 4450, 12% below yesterday’s close. Neither assumption is overly conservative, in our opinion. For instance, if the economy enters a recession, then earnings should be more likely to shrink. Bottom line: We believe that continuing to exercise patience is appropriate.

- We are reviewing our core equity holdings as well as our watchlist of U.S. large cap companies that we don’t currently own and looking for opportunities to upgrade quality at attractive price points. While we revisit our research on numerous businesses and industries, we recognize that relying solely on our prior analysis would be incomplete work. We must seek to understand the implications of a seemingly changed world order.

We hope these insights are helpful. If you have any feedback or questions, please reach out to a member of the Investment Team or you Advisor.